Expert GST Services in India

Comprehensive GST Solutions by Certified GST Specialists

The Goods and Services Tax (GST) is a comprehensive, indirect tax levied on the supply of goods and services within India. It replaced multiple taxes like excise duty, service tax, VAT, etc, creating a unified tax structure. This reform simplified the tax system, reduced paperwork, and made the tax process more transparent.

It aims at reducing complexity and minimizing the cascading effect of taxes. Implemented on July 1, 2017, GST has general rates ranging from 5% to 28%, depending on the nature of goods and services, managed through respective HSN/ SAC codes. Businesses are required to file monthly, quarterly, and annual returns based on turnover, as per their chosen option.

GST Applicability

GST slabs (5%, 12%, 18%, and 28%) determine the tax rate for goods and services. Understanding the applicable slab for your business is essential for compliance. Our GST specialists will analyze your business requirements and provide optimal solutions.

1. Basis Turnover

- General Threshold:

- For Goods: Any business supplying goods within the same state with an annual turnover exceeding Rs. 40 lakhs (Rs. 20 lakhs in some special category states) must register for GST.

- For Services: Businesses supplying services with an annual turnover exceeding Rs. 20 lakhs (Rs. 10 lakhs in some special category states) must register for GST.

- Specific Exceptions: Some businesses, such as specific agricultural producers and religious institutions, are exempt from registration even if they exceed the threshold.

- Aggregate Turnover: Consider your total turnover from all your business activities across India, not just individual branches or products, as is seen in the PAN of the business house.

2. Interstate Supply

If goods or services are supplied across state borders, you must register for GST, regardless of turnover.

3. Specific Activities

Certain activities, such as e-commerce platforms, casual taxable persons, and TDS/TCS collectors, also require registration, regardless of turnover.

4. Voluntary Registration

Businesses register voluntarily with GST authorities to avail of input tax credits, establish business identity, participate in government tenders, or anticipate crossing the turnover threshold.

GST Advisory Services

Optimize Your Tax Positions with Our Expert Guidance

GST Impact Assessment

Analyze the potential impact of GST on business, including changes in input tax credit (ITC), pricing strategies, and supply chain processes.

GST Registration Assistance

We handle the entire GST registration process, including documentation, applicability assessment, and filing, ensuring accuracy and timely completion.

Compliance System Setup

Help you implement robust compliance systems, including record-keeping procedures, filing mechanisms, and internal controls.

GST Return Filing Support

Assist you with filing accurate and timely GST returns, minimizing errors and penalties.

Record Maintenance

Maintain all records, such as the sales register, including invoices, credit notes, delivery challans, the ITC register, and tax payment challans, as per the provisions of the GST Act.

ITC Optimization

Guide you on maximizing ITC claims and utilizing credits efficiently to reduce GST liability.

ITC Reconciliations

Provide real-time reconciliation of credits and follow up with vendors in case of misinformation. Review vendor contracts to offer sufficient legal support.

Liaison with Tax Authorities

Represent you before tax authorities for issues like clarifications, assessments, and disputes.

Compliance Audits and Reviews

Conduct periodic compliance audits and reviews to identify potential risks and ensure ongoing compliance with GST regulations.

Business Process Optimization

Analyze and suggest improvements in your business processes to optimize GST compliance and improve operational efficiency.

GST Registration Support Services: Ensure a Hassle-Free GST Registration Process

GST registration is mandatory for businesses whose turnover exceeds a certain threshold. Our GST registration support ensures your business is fully compliant and efficiently registered.

Assessment and Requirement Determination

- Analyze the client’s need for GST registration based on business activities.

- Determine applicable GST rates for goods and services.

- Identify principal and additional business locations for compliance.

Document Preparation

- Collect and verify identity, address, business continuity, and other documents relating to business owners to ensure all documentation is complete and available at the time of registration.

Registration Process

- File and manage the GST registration application for a smooth and quick approval.

- Address and resolve any queries raised by GST authorities regarding the furnished documents.

Amendment Services

- Update registration details for office changes, additional places of business, or changes in directors/business owners.

Handling Cancellations and Suspensions

- Assist in restoring canceled or suspended GSTIN

- Represent before the appellate authorities, if needed.

Tax Planning

Tax planning under GST involves strategizing to determine correct tax liabilities for services/goods categories while ensuring compliance with tax laws and maximizing savings

GST Returns and Due Dates: Stay Compliant with Timely Filings

Taxpayers must submit their GST returns and pay any owed taxes by the deadlines. Adherence to these deadlines is crucial to avoid penalties and fines. Each type of return (monthly, quarterly, and annual) has its specific due date.

These dates may vary depending on the type of taxpayer, but our experts are here to assist you throughout the process.

| GST Return | Frequency | Applicability | Due Date for Filing |

|---|---|---|---|

| GSTR 1 | Monthly | Regular Taxpayer (having turnover more than Rs.1.50 Crore) | 11th of the following month |

| GSTR 1 | Quarterly | Regular Taxpayer (having turnover up-to Rs.1.50 Crore) | 13th of the following quarter |

| GSTR 3B | Monthly | Regular Taxpayer (Not opting for QRMP scheme) | 20th of the following month |

| GSTR 3B | Quarterly | Regular Taxpayer (opting for QRMP scheme) | 22nd and 24th of the month following the end of the quarter, depending upon the state |

| GSTR 4 | Annually | Composition Taxpayer | 30th April of the following FY |

| GSTR 5 | Monthly | Non-Resident Taxpayer | 13th of the following month |

| GSTR 6 | Monthly | Input Service Distributor | 13th of the following month |

| GSTR 7 | Monthly | TDS deductors u/s 51 | 10th of the following month |

| GSTR 8 | Monthly | TCS collectors u/s 52 | 10th of the following month |

| GSTR-9 | Annually | Regular taxpayers whose Turnover exceeds 2 Crores in the FY. | 31st December of the following financial year |

| GSTR-9A | Annually | Composition taxpayers whose Turnover exceeds 2 Crores in the FY. | 31st December of the following financial year |

| GSTR-10 | Once | Final return after surrender or cancellation of GST registration. | Within 3 months of date of surrender or cancellation of registration. |

GST Refund

Recover Excess Tax Paid Under the GST Regime

In India, the GST refund process offers eligible businesses the opportunity to recoup excess taxes paid under the GST regime. If you’ve paid more than your fair share, it’s time to reclaim what’s rightfully yours.

Types of GST Refund

- Inverted duty structure refunds: When the tax paid on inputs is higher than the tax liability on the output side. Business can claim a refund for the difference.

- Refund of tax payment: Business exporting goods or services with GST payments can claim a refund of the paid tax.

- Refund of ITC: If a business has exported goods or services without a tax payment by reporting the Letter of Undertaking (LUT) or bond and has accumulated ITC, then they can claim a refund of proportionate ITC.

- Other refunds: In specific situations, like excess cash deposited or tax paid by mistake, certain other types of refunds are also available.

GST Refund Services

- Expert Analysis: Carefully review your financial records and identify all potential refund opportunities.

- Streamlined Documentation: We relieve you from the burden of paperwork by gathering, organizing, and preparing all necessary documents to ensure a smooth application process.

- Unwavering Advocacy: Represent your interests before the GST authorities, advocating for your rightful refund with unparalleled expertise and professionalism.

- Constant Communication: Keeping you informed at every step, providing transparent updates and progress reports.

GST Litigations

Expert Legal Support for GST Compliance

Litigation in GST refers to legal disputes between taxpayers and tax authorities regarding GST compliance, tax calculations, input tax credit claims, etc. It’s crucial for businesses to stay informed about potential litigation and seek professional advice for effective resolution.

At Guidwell , we are dedicated to offering comprehensive legal support to taxpayers, ranging from GST registration to the management of GST refunds and cancellations.

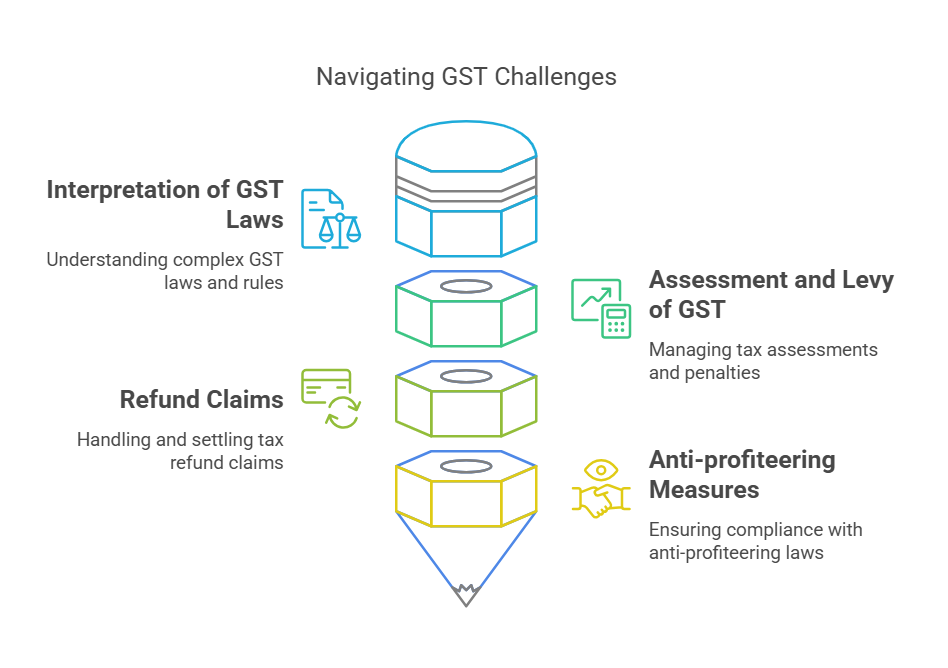

Our expertise extends to resolving a range of challenges associated with GST litigations, which we are committed to addressing.

- Interpretation of GST laws and rules: The GST laws and rules include complex procedures regarding the classification of goods and services, the rate of tax applicable, the eligibility for input tax credits (ITC), and the place of supply of goods or services.

- Assessment and levy of GST: Challenges relating to assessments made by the tax authorities, penalties imposed for non-compliance, and demands for payment of tax dues.

- Refund claims: Taxpayers need to settle refund claims every time they may be rejected by the authorities.

- Anti-profiteering measures: Anti-profiteering GST litigations can be Intricate to handle and need professional hand-holding for businesses. We offer expert support to help businesses manage these challenges, ensuring compliance and effective representation in disputes.

FAQs

1. Why GST is an indirect tax?

Under modern business condition a trademark performs four functions

- It identifies the goods / or services and its origin.

- It guarantees its unchanged quality

- It advertises the goods/services

- It creates an image for the goods/ services.

2. Why GST is an indirect tax?

Registration under the goods and service tax (GST) regime will confer the following benefits to the business.

- Constitutionally recognized as supplier of goods or services.

- Proper accounting of taxes paid on the import of goods or services which can be used for remittance of GST due on supply of goods or services or both by the business.

- Legally allowed to accumulate tax from his buyers and pass on the credit of the taxes paid on the merchandise or services supplied to purchases or recipients.

- Acquiring entitlement to avail various other advantages and privileges rendered under the GST laws.

3. Can an individual without GST registration claim ITC and collect tax?

No, an individual without GST registration can neither collect GST from his consumers nor assert any input tax credit of GST remunerated by him.

4. Under the GST, who is needed to file returns consistently and who isn’t?

Every registered taxable individual is needed to file returns under the GST law. If you have not carried out any business activities during the period covered by a return, you must file a nil return. Some entities will be required to listed for GST but aren’t needed to file returns regularly, such as UN bodies (and foreign ministry) must list for a distinctive GST ID. Still, they are required to file returns only for months during which they make purchases. In addition, some entities do not need to register or file returns. For example, government entities and public sector undertakings (PSUs) entities dealing with non-GST supplies and those who deal with exempted/ nil rated/non-GST goods and services will neither be required to register under the GST nor file returns.

5. What are the distinct types of GST returns?

Different types of GST returns are:

- GSTR-1: Monthly return for outward supplies

- GSTR-2: Monthly return for inward supplies

- GSTR-3: Monthly return containing items from other monthly returns filed by the taxpayer (GSTR-1, GSTR-2, GSTR-6, GSTR-7)

- GSTR-4: Quarterly return

- GSTR-5: Variable return to be filed by non-resident taxpayers

- GSTR-6: Monthly return to be filed by input service distributors

- GSTR-7: Monthly return to be filed for tax removed at source (TDS) transactions

- GSTR-8: Monthly return to be filed by e-commerce operations

- GSTR-9: Annual return

- GSTR-10: Final return to be filed when discontinuing business activities indelibly

- GSTR-11: To be filed by taxpayers with a unique identity number (UIN)

6. What is GSTR 9C (GST audit form)?

GSTR 9C is an annual audit form for all taxpayers having a turnover above two crores in a specific calendar year. Along with the GSTR 9C audit form, the taxpayer will also have to fill up the reconciliation statement along with the document of an audit.

7. What are the documents to be enclosed with Form GSTR-9C?

The following documents are required to be encompassed along with Form GSTR-9C. A copy of the audited financial statements as per section 35(5), copy of the audit report where another person carries out the entity’s audit under a statute other than the GST Act.

8. What services do you offer under indirect taxes (GST)?

At Guidwell, we assist you with the following services that make it easy for you to comply with the tax regime:

- GST registration

- GST returns

- GST amendments

- GST audits

- GST assessments

- GST compliances