Foreign Direct Investment (FDI)

Foreign Direct Investment (FDI)

“Welcome to the Gateway of Growth: Investing in India”

India is a thriving mosaic of diversity and progress and stands as one of the world’s fastest-growing economies, with a population exceeding 1.4 billion. As we enter the dynamic year 2024-25, India’s GDP is poised to surpass $4 trillion, securing its position as the fifth-largest economy globally. The country’s remarkable growth, anticipated at 6.5% this year, outpaces even China, setting the stage for India to become the world’s third-largest economy by 2027, according to IMF projections.

Fuelling this economic ascent are strategic reforms, transforming India into an investment haven. Recent initiatives include liberalizing foreign investment restrictions, modernizing labor and bankruptcy laws, and implementing a national Goods and Services Tax; these actions and commitment to self-dependency positioned India as a promising destination for global investors.

Investment Climate: A Golden Opportunity

India’s investment climate has significantly improved since the economic reforms of 1991. In the fiscal year 2022, India attracted a record foreign inflow of US$83.6 billion, a testament to its attractiveness to investors. The country now stands proudly among the top 100 in the Ease of Doing Business index.

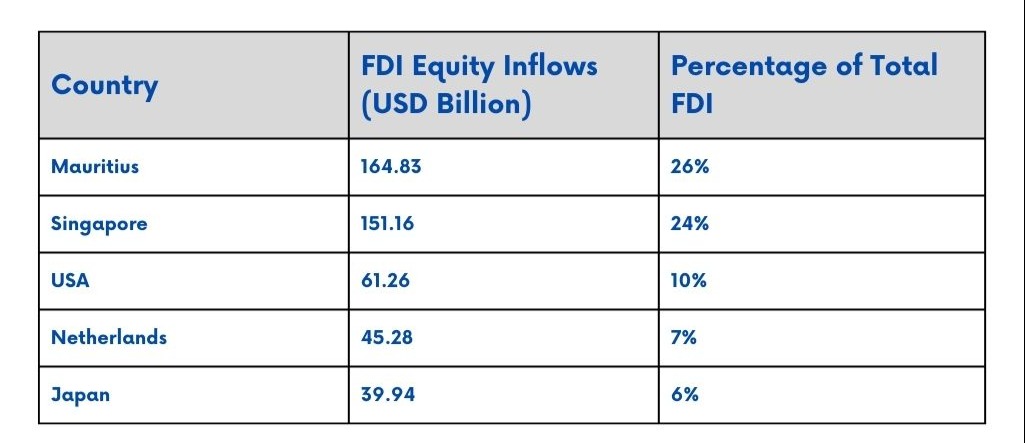

Over the last 23 years, total FDI inflows has reached $953.143 billion, with the previous 9 years accounting for nearly 65% of this figure.

Sectors and States: A Tapestry of Opportunities

Diving into the specifics, these sectors and states are leading in attracting FDI Equity Inflows, collectively shaping India’s economic landscape.

Embark on a journey of opportunity, growth, and success. Explore the Gateway of Growth – Invest in India.

Why Invest in India?

India, a key player on the global economic stage, takes the lead in a spectrum of industries, ranging from cutting-edge information technology to the vibrant sectors of agriculture and manufacturing. Securing a remarkable fifth position in the world’s GDP rankings, India’s economic landscape is adorned with a broad domestic market, a tech-savvy workforce, and a thriving middle class.

Adding depth to this dynamic scenario is India’s distinctive demographics, marked by a youthful median age of 28.2 years. Exhibiting resilience in the face of global challenges, the Indian economy consistently outperforms major emerging markets, standing as a testament to its enduring strength. Navigating the post-pandemic recovery, India’s narrative unfolds with a sizable consumer base, escalating urban incomes, and the dreams of a young populace, shaping a robust and promising economic trajectory.

In this context, let’s explore the key reasons that firmly establish India as a premier destination for investment and business growth.

| Types | Comments |

|---|---|

| Ease of Doing Business | Ongoing efforts to improve the ease of doing business for foreign investors. |

| Favorable FDI Environment | Most sectors are open for foreign investments. |

| Growing Economy | Strong and consistent GDP growth, competing globally and regionally. |

| Incentives for Doing Business | Various incentives available based on economic activity, industry, location, and firm size. |

| Infrastructure Development | Nationwide policies focused on constructing, refurbishing, strengthening, and expanding infrastructure. |

| Integration with Legal Frameworks | WTO member and signatory of major worldwide Intellectual Property Protection conventions, protocols, and agreements. |

| Large, Young Labor Force | Over 1 billion young workers aged 15 to 64, India boasts a significant workforce. |

| Largest Marketplace | Largest marketplace globally with a population surpassing 1.4 billion. |

| Network of FTAs and DTAs | Signatory of over 54 Free Trade Agreements and one of the largest networks of tax treaties. |

| Network of SEZs | Multiple Special Economic Zones (SEZs) offering competitive infrastructure, duty-free exports, and tax incentives. |

| Remittances | Permitted net of taxes depending on the type of business setup. |

| Strategic Location | A strategic manufacturing destination and a major investment hub in South Asia. |

| Strategic Location | Well-connected to central, west, southeast, and east Asian countries. |

| Taxation | Recent changes in the tax regime have aimed at reducing rates and simplifying processes. |

| Winding Up | Feasible business winding up options (subject to compliance status). |

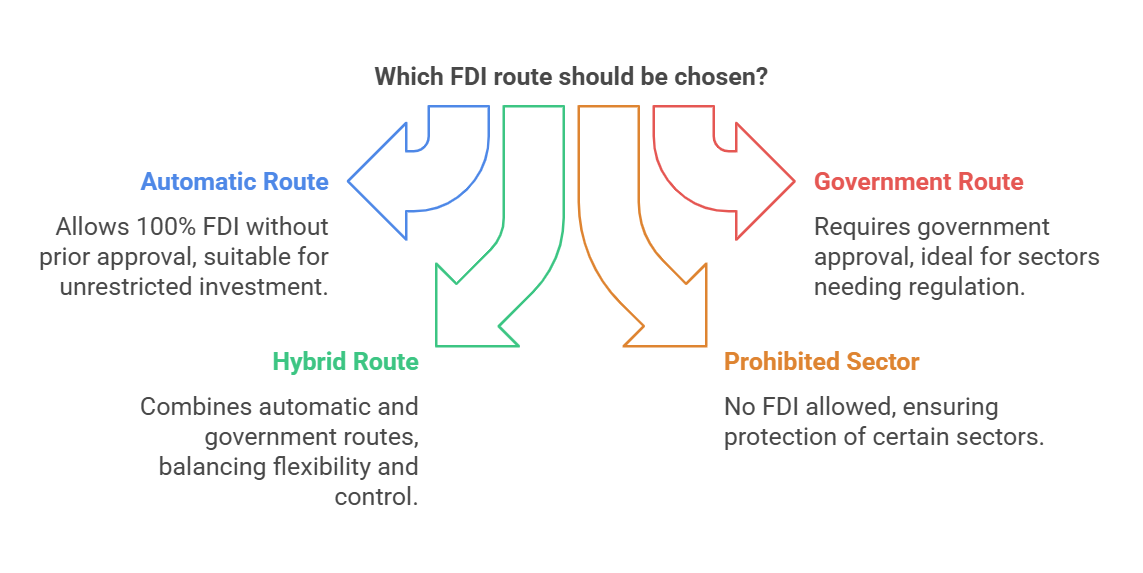

Routes of FDI Investments

Understanding the avenues through which foreign direct investment flows into India is crucial. Here are the key routes:

Automatic Route

The non-resident or the Indian company does not require any approval from RBI or the Indian government for the investment under the automatic route.

non-resident include foreign entities / foreign individuals

Government Route

Prior to investing in India, approval is required from the RBI or Indian Government through the Government Route. Proposals for foreign direct investment under the Government route are reviewed by the relevant Administrative Ministry/ Department.

Automatic Route and / or Government Route

Investment through FDI in some sectors is allowed up to a certain limit through an automatic route. As soon as the upper limit is triggered, the same will require prior approval from the government.

Prohibited Sectors

Foreign technology collaboration in any form, including licensing for franchise, trademark, brand name, and management contracts, is also prohibited for Lottery Business, Gambling, and Betting activities.

For a detailed study on sector-wise FDI norms, please refer to Consolidated FDI Policy 2020

| Type of Investor | Comments |

|---|---|

| Non-Resident Entity | Entities not residing in India |

| NRIs in Nepal and Bhutan, Citizens of Nepal and Bhutan | NRIs residing in Nepal and Bhutan, as well as citizens of these countries |

| Company, Trust, and Partnership Firm Incorporated Outside India Owned and Controlled by NRIs | Entities like companies, trusts, and partnership firms incorporated outside India but owned and controlled by NRIs |

| Foreign Portfolio Investors (FPI) | FPIs are eligible for FDI |

| Registered FPIs and NRIs | Both registered FPIs and NRIs are eligible for FDI |

| Foreign Venture Capital Investor (FVCI) | FVCIs are recognized as eligible investors in the FDI framework |

| NRI or OCI Subscribing to National Pension System (NPS) | NRIs or Overseas Citizens of India (OCI) subscribing to the National Pension System governed by the Pension Fund Regulatory and Development Authority (PFRDA) |

| Type of Investee Entity | Eligibility |

|---|---|

| Indian Company | Indian companies can issue capital against FDI |

| Partnership Firm/Proprietary Concern | NRIs can invest in the capital of a firm or proprietary concern in India on a non-repatriation basis, subject to specified conditions under the Consolidated FDI Policy 2020 |

| Trusts | Investment by a person residing outside India is not permitted in trusts, except in those registered and regulated by SEBI as ‘VCF’ (Venture Capital Fund) and ‘Investment vehicle’ |

| Limited Liability Partnerships (LLPs) | Foreign investment in LLPs is permitted, subject to conditions specified under the Consolidated FDI Policy 2020 |

| Investment Vehicle | Entities designated as ‘investment vehicle’ and registered under relevant regulations framed by SEBI or any other relevant authority are eligible |

| Start-up Companies | Start-ups can issue equity, equity-linked instruments, convertible notes, etc., to individuals residing outside India, subject to specified conditions |

How Guidewell Can Help

We offer comprehensive support for foreign investors:

- Identifying potential investment areas.

- Formulating investment strategies.

- Liaising with potential Investee Entities.

- Setting up an Indian entity.

- Obtaining regulatory approvals for investment.

- Managing regulatory compliances.