Sez – Special Economic Zones

A Special Economic Zone (SEZ) is a designated geographical area with unique rules and regulations that distinguish it from other parts of the country. These zones offer special economic policies designed to encourage foreign direct investment. Operating within an SEZ can be highly beneficial for businesses, as companies enjoy tax incentives and lower taxes. Many Asian countries, including India, were among the first to adopt the export processing zone (EPZ) model to boost exports.

An SEZ can be considered a duty-free zone, where businesses are exempt from high excise duties and government charges. Companies operating in these zones receive tax exemptions, including on income tax, excise duties, and customs duties, as well as subsidies on utilities like water and electricity. Essentially, an SEZ exists outside the regular customs boundaries of India, specifically for authorized operations.

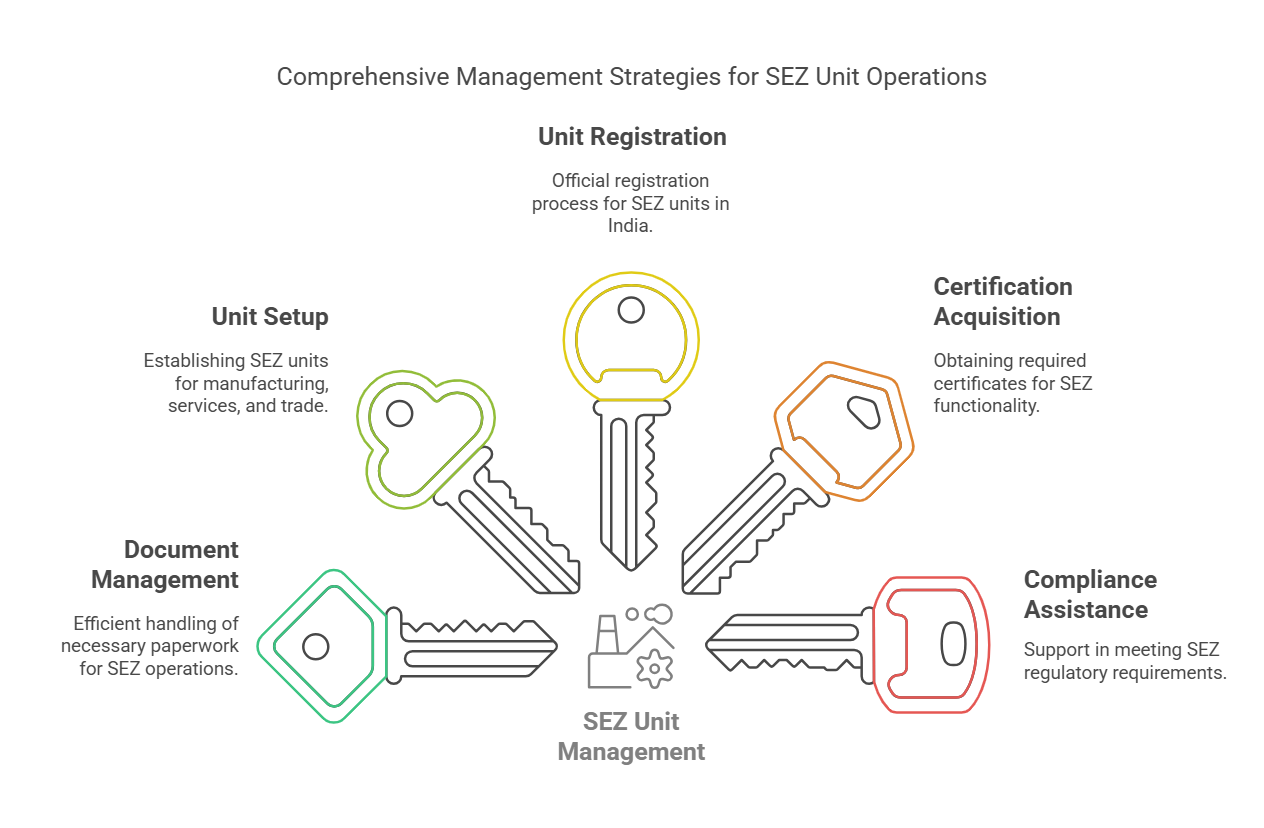

We can assist you in

- Filling and submission of requisite documents

- Setting up SEZ units for various purposes like manufacturing, rendering of services and trading

- Registration of a SEZ unit in India

- Obtaining certificates for the functioning of a SEZ

- Providing various kinds of reports

- Assisting in requisite SEZ compliances

To sum up the entire gamut of services provided by us, we render assistance throughout the procedure for obtaining a SEZ approval.

FAQs

1. Why is SEZ important?

SEZ in India is especially a delimited enclave. The economic laws in this geographical are different from the prevailing laws in other parts of India. An SEZ is deemed foreign territory for matters related to trade tariffs, duties, and operations. The SEZ Act of 2005 governs all SEZs’ regulatory and legal aspects and units under SEZs.

2. What are the benefits of SEZ?

The primary objectives of the SEZ Act are as follows:

3. How do I set units in SEZ?

For setting up a unit in Private Special Economic Zone, the applicant has to apply online and submit the print out of the online filled in Form F, duly, signed along with the required documents.

4. Which is the first SEZ in India?

The Indian government had long used export processing zones (EPZs) to promote exports. In fact, Asia’s first EPZ was established in 1965 at Kandla, Gujarat state.

5. How many SEZ’s are there in a country?

There are nearly 5,400 SEZs today, more than 1,000 of which were established in the last five years.

6. What are the guidelines for setting up SEZs?

The guidelines (determined in Section 5 of the SEZ Act, 2005) for the consent of SEZs are

- Generation of additional economic activity

- Promotion of exports of goods and services

- Promotion of investment from domestic and foreign sources

- Formation of employment opportunities

- Development of infrastructural facilities

- Maintenance of supremacy and integrity of India

7. What are the incentives and facilities provided to the units in SEZs for attracting investments into the SEZs, including foreign investment?

The incentives and facilities provided to the units in SEZs for attracting investments into the SEZs, includes:

- Duty free import/domestic procurement of goods for development, operation and maintenance of SEZ units.

- 100% Income Tax exemption on export income for SEZ for first 5 years, 50% for next 5 years thereafter and 50% of the worked back export profit for next 5 years.

- Exemption from Central Sales Tax, Exemption from Service Tax and Exemption from State sales tax. These have now subsumed into GST and supplies to SEZs are zero rated under IGST Act, 2017.

- Other levies as imposed by the particular State Governments.

- Single window clearance for Central and State level approvals.

- Supplies to SEZ are zero rated under IGST Act, 2017.

8. Which are the key entities in the SEZ Scheme?

The key entities in the SEZ scheme are:

Department of Commerce (DOC)

The function of DOC is the and analyzing of the strategy including regulatory structure for SEZs. The highest decision making body for SEZs namely the Board of Approval (BOA) is also managed by the DOC.

Office of Development Commissioner

The office of the Development Commissioner (DC) administers the regulatory framework of SEZs. This includes administrative approvals, whichever by the Unit Approval Committee or the DC on file. The customs officers are manage for the customs clearances of goods and services to and from the SEZ.

Developer

A Developer means a person who, or a State Government which, has been allowed a LOA for setting up and infrastructure development of the SEZ. While, most SEZs have only a single developer, there is a provision in Section 3(10) of SEZ Act to approve more than one Developer in cases where one Developer does not have in his possession the minimum area of contiguous land, for setting up a SEZ.

Co-developer

A Co-Developer is any entity co-operated by the developer for setting up infrastructural facilities in the accepted SEZ. He would need to enter into an agreement with the Developer. The proposal for any co-developer, if approved by the BOA, is allowed an LOA by the BOA for the same.

SEZ Units

Units are entities that are esentally who have been assigned LOA for engaging in exports (including deemed exports), imports, domestic sourcing and domestic sales of goods and services under the SEZ managing framework. It also includes Offshore Banking Units and Units in an International Financial Services Centre.

9. What is the specific consent required from the State Government for setting up of an SEZ?

The developer requires a certificate from the concerned State Government or its authorized agency stating that the developer(s) have:

- Legal possession

- Irrevocable rights to develop the said area as SEZ

- The said area is free from all encumbrances

The State Government shall, while advicing a scheme for setting up of Special Economic Zone to the Board indicate whether the proposed area falls under reserved or ecologically fragile area as may be specified by the concerned authority. Where the Board approves a proposal received for setting up an SEZ, the person shall obtain concurrence of the State Government within six months from the date of such approval.

10. What are the executed given by the State Government to the SEZs?

The State Government is not directed but shall undertake that the following are made available in the State to the suggested SEZ Units and Developer, namely:

- Exemption from the State and local taxes, State Goods and Services Tax, levies and duties, including stamp duty, and taxes levied by local bodies on goods required for authorized operations by a Unit or Developer, and the goods sold by a Unit in the DTA except the goods acquired from DTA and sold as it is.

- Exemption from electricity duty or taxes on sale, of self-generated or purchased electric power for use in the processing area of a SEZ.

- Permit generation, transmission and distribution of power within a SEZ.

- Providing water, electricity and such other services, as may be required by the developer be provided or caused to be provided.

- Legation of power to the DC under the Industrial Disputes Act, (No. 14 of 1947) and other related Acts in relation to the Unit and workmen employed by the developer.

- Declaration of the SEZ as a Public Utility Service under the Industrial Disputes Act, (No.14 of 1947).

- Providing single point authorization system to the Developer and unit under the State Acts and rules

11. How can a SEZ unit exit from the SEZ?

The unit may opt out of Special Economic Zone with the sanction of the DC and such exit shall be subject to payment of relevant duties on the imported or innate capital goods, raw materials, components, consumables, spares and finished goods in stock, if the unit has not attained positive NFE, the exit shall be subject to penalty that may be inflicted under the Foreign Trade (Development and Regulation) Act, 1992.

The following situations shall apply on the exit of the Unit:

- Penalty inflicted by the competent control would be paid and in case an appeal against an order imposing penalty is pending, exit shall be contemplated if the unit has acquired a stay order from competent authority and has acquired a Bank Guarantee for the penalty determined by the appropriate authority unless the appeal authority makes a specific order exempted the unit from this requirement;

- In case the unit has failed to fulfill the terms and conditions of the LOA and penal opeartions are to be taken up or are in process, a legal undertaking for payment of penalties, that may be imposed, shall be accomplished with the Development Commissioner;

- The unit shall continue to be managed a unit till the date of final exit.